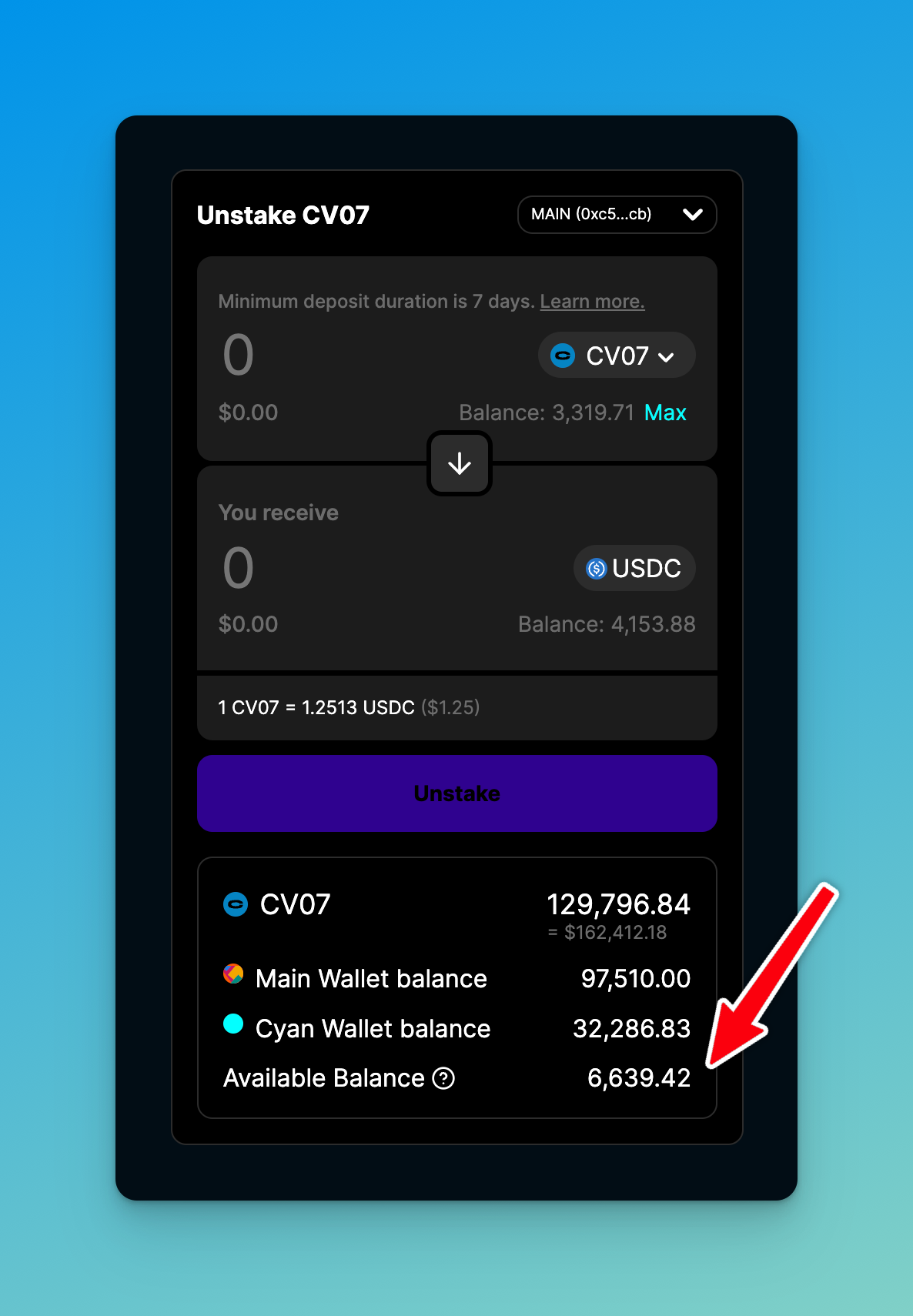

Available balance

This is the amount of ETH you are able to withdraw now.

The available balance is a representation of the amount of ETH you can unstake at the current observation time.

The available balance will not match the amount you have staked, given a few factors:

- Utilization rate

- Safety margin

- Defaulted NFT marks

- Deposit lock period (new deposits have a minimum 7-day staking period)

The utilization rate is a calculation of deployed capital (ETH used to fund BNPL and Pawn plans) divided by the total amount of ETH staked in the Vault. If the staked amount is 100 ETH and there are currently 50 ETH being used to fund NFT loans, the utilization rate is 50%.

A safety margin is implemented into all Vaults, with a default value of 10%. The rate is used to keep a buffer of ETH in the Vault for liquidity and supply-demand management. If 100 ETH is staked into the Vault, 10 ETH will be kept untouched as a safety buffer.

Defaulted NFTs will accumulate in the Vault over time as users default on NFT loans. A daily appraisal of each asset will be conducted to ensure the token price is representative of market prices. This appraisal may be made more frequently if prices are fluctuating.

Based on the criteria above, the 'Available balance' will be calculated and displayed on the Vault position. Balances for both your Main Wallet and Cyan Wallet are available at a glance:

The Available Balance shown is a total between the Main and Cyan wallets

Funds are Safu

The available balance will not always match up to 100% of the value you have staked into the Vault. In the near future, we plan to start AMM pools for Vault tokens to help aid liquidity for those wishing to unwind at secondary-market rates.

Updated 8 months ago